CBK Announces Changes in All Bank Loans

The Central Bank stated that the changes would help promote responsible lending...

✨ Key Highlights

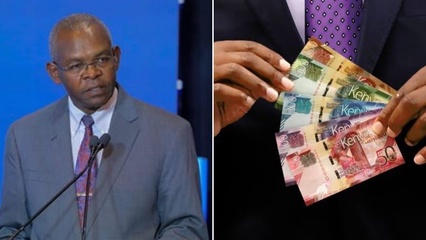

The Central Bank of Kenya (CBK) has introduced a new risk-based credit pricing model for all bank loans, replacing the previous Central Bank Rate (CBR) system. This change aims to align interest rates with borrowers' risk profiles and enhance transparency in lending.

- All new variable rate loans will adopt the new model starting September 1 this year.

- Existing variable-rate loans will transition to the new system beginning February 28, 2026, after a 6-month period.

- The new formula is anchored on the Kenya Shilling Overnight Interbank Average (KESONIA), plus a premium ("K") covering lending costs, shareholder returns, and the borrower’s risk.

- CBK Governor Kamau Thugge confirmed the changes, following extensive consultations with diverse stakeholders.

Continue Reading

Read the complete article from Kenyans